There's a great analog here to crypto in 2021.

Back then a wave of genuine innovation (DeFi, onchain trading, new L1s, rollups, etc...) led to a tsunami of new tokens.

Uniswap led to SushiSwap and a million other clones whose names you've forgotten, yield farming at Compound kicked off Yam.

It's easy to look back at those failures as obvious, but what most people forget is these businesses were doing REAL revenue.

REV for 2021 was $12B (!!), or 3X what it is today when you have arguably 10X the amount of real institutional adoption.

Most of those new tokens failed, as most forks were useless. Easy come, easy go.

The final phase, what crypto is going through now, is consolidation and a focus on distribution.

The same thing is going to happen with these new vibe coded apps.

We aren't heading towards a world of 25 DoorDashes, but that also doesn't mean things won't get weird and some genuine disruption along the way.

Jane Street made $10 billion in trading revenue in a single quarter.

For scale reference- thats more than Goldman, JP Morgan, Citi, or Bank of America managed in the same period

They got banned from India’s stock market last year for manipulating a national index. They seized $570 million and called them “not a good faith actor that deserves to be trusted”

Today they’re being sued for insider trading that helped trigger the $40b Terra collapse.

And because they’re classified as a trading firm and not a hedge fund, they’re exempt from the disclosure rules that would force them to show you how they actually make their money.

This is also the firm that handles BlackRock’s bitcoin ETF, btw

Why stablecoins?

The promise of crypto has always been to bank the unbanked. There’s billions of people who don’t have access to basic savings and spending products and blockchains can change that.

We’ve been saying that for 15 years and haven’t come close to delivering on the promise yet. Crypto is still primarily just an investment vehicle for rich people. BTC and ETH are too new and volatile for billions to trust it for saving and spending.

There’s a massive opportunity for mobile apps that are natively onchain and stablecoin first to finally deliver on the promise. Many great teams are starting to in South America, Middle East, South East Asia, Africa, etc but we are in the first inning 🚀

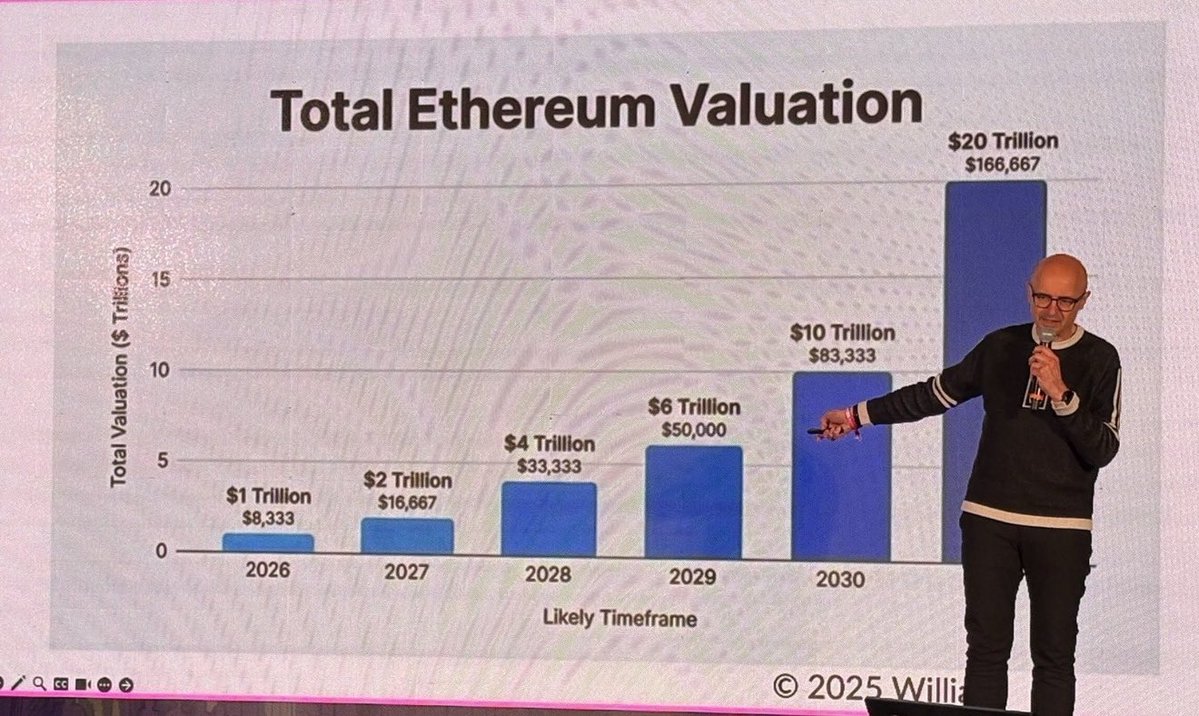

看了William Mougayar对以太坊的估值逻辑,这么多年,难得看到在以太坊估值看法上相似度能达到60%以上的了。还有部分看法不同,以后有机会再说。

先来看看他的想法:

他将以太坊看作为一种“全球公共物品”(global public good),类似于互联网的基础协议(如TCP/IP),而非传统盈利公司。

他的视角强调以太坊的非竞争性、非排他性和系统赋能特性,其价值来源于它为全球金融和交易提供的信任层和基础设施,而不是单纯的费用收入或短期指标。

Mougayar提出一个三部分估值框架:

• Captured Value:直接捕获的价值部分,如交易费用、MEV(矿工/验证者可提取价值)等。但他认为这只是冰山一角,无法全面反映以太坊的潜力。

(注:这一点赞同,尤其是早期,以太坊不是科技公司,无法用P/E估值)

• Flow Value:基于以太坊处理的年度经济流量(annual economic flows),例如稳定币结算、DeFi交易和RWA(真实世界资产)等。

2025年数据显示,以太坊处理的稳定币交易量已超过18.8万亿,整体流量可能超过50万亿。应用基础设施估值倍数(类似于评估SWIFT或国家经济),这部分可贡献3000亿至3万亿的估值。

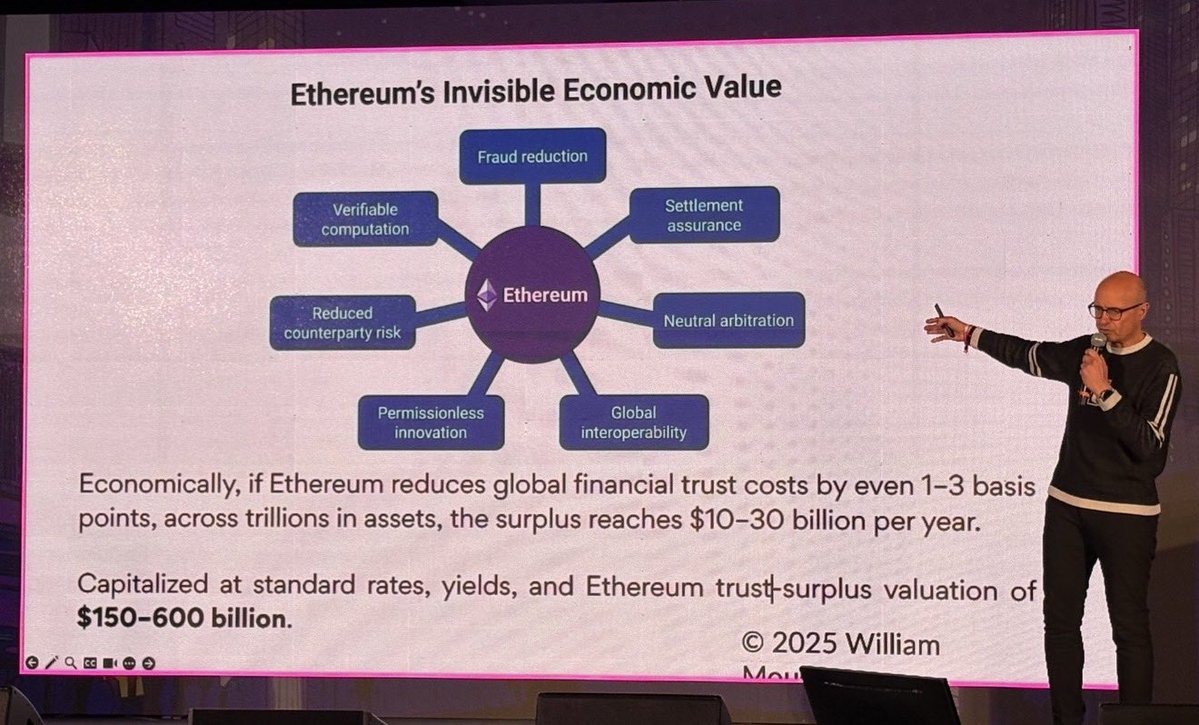

• Trust Surplus:这是最具创新的部分,捕捉以太坊通过减少全球金融信任成本(如欺诈减少、对手风险降低、结算保障、中立仲裁、无许可创新和全球互操作性)产生的经济盈余。

即使仅降低1-3个基点(0.01%-0.03%)的信任成本,在数万亿资产规模下,每年可产生10-30亿的盈余。资本化后(以标准利率和收益率计算),这部分价值可达1500亿至6000亿。

综合这些,Mougayar估计以太坊当前的内在价值在2-6万亿之间(保守估计1万亿),远高于2025年底约4000亿的市场估值。他预测,如果以太坊继续演变为全球信任和结算网络,到2030-2035年,其总估值可能达到10-20万亿。

对于ETH价格的趋势,跟Mougayar的看法类似,但他的价格趋势更偏线性发展。

个人看法是,未来2-3年eth还会处于相对低估状态,市场没有充分计价,一直在1万美元内拉锯。不过,3-5年后会发生真正的奇点时刻,ETH价格开启非线性的暴涨,达到目前大家不敢想象的阶段。

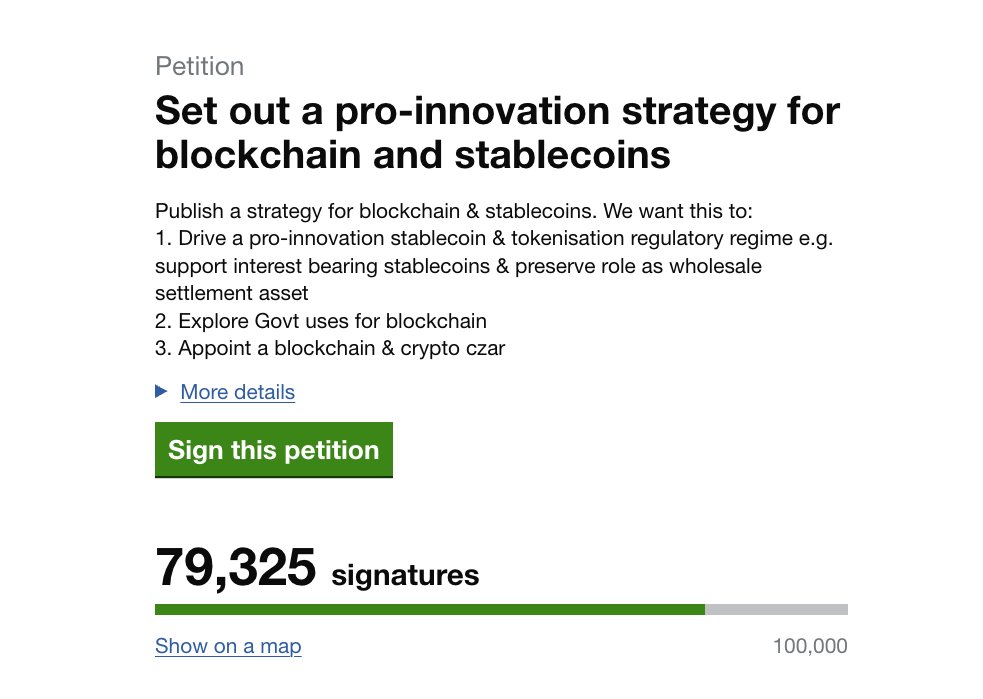

Stablecoin rules in the UK are being finalized, and are at risk of preventing the UK from being globally competitive in the digital economy.

For example, the Bank of England is proposing a cap on stablecoin holdings for individuals and businesses.

The UK has a long history of being a financial hub. Embracing and encouraging innovation, especially when other countries are moving fast here, is important for maintaining that. The current direction of the rules does the opposite, and will act as an innovation blocker.

If you're from the UK you can sign the petition by @StandWCrypto_UK to set out a pro-innovation strategy for blockchain and stablecoins. Link below.

别看推上一片悲观

现在跑步进场币圈的有相当一部分未成年人

曼谷这边小孩班上就有3个dev了,一个印度裔,一个美中混血,一个希腊,都会用Pump Fun,发过几个rug盘,还会说You just got farmed

然后我还疑惑这钱包都是谁给的,结果家长一交流发现都是币二代

而且小孩喊单的方式是非常神奇的 - 在Minecrafts和Roblox里喊单

这边语音挖着钻石呢那边突然大喊buy $XXXX !一些专属的小孩梗比如brainrot或者67,我都没弄明白,都是看他们我才懂是啥

搞得我小孩的币圈启蒙竟然不是从我开始的,只能把 那个Biannce Junior给她玩玩先

但说实话,战壕很显然感召力更强,事教人一教就会

USD1 被fud脱锚这件事,根源在于很多人对于托管型稳定币不了解,包括大家最信任的USDC,它们的运行机制都是合格用户/机构把美元存入合规发行商的储备账户,然后在链上铸造对应数量的稳定币。

比如USDC背后是Circle,USD1背后是BitGo,原理和机制上没有任何区别,市场的信任基本建立在品牌背书上。

透明度上靠按时披露储备报告,作恶方面靠监管约束,如果你不接受这种合格托管+定期证明的方式,那么理论上USDC也是不安全的,但这个周期有了GENIUS Act稳定币法案,合规监管在完善,未来这种稳定币会是市场主流。

I'm actually pretty open-minded about the anti-data-center populism.

From everything I've seen from people working on this, reducing industrial-scale hardware availability seems to be both the most practical, and most non-dystopian / non-invasive way to lengthen AGI timelines.

So if the movement that makes that happen starts out with anti-data-center populism, that seems fine?

Of course you have to do things other than going after data centers located in populated areas to really make a dent on AGI timelines (my intuition is that 10-100x compute reduction is feasible in a "static" model of the world, and 100-10000x if you compare to a counterfactual that includes future chip design progress; those numbers *would* make a dent), but there is a first step for everything.

《2028年全球智能危机》不是危言耸听,而是很大概率会到来的现实。熟悉了数十年的现代信贷经济体系会被逐渐瓦解。它的核心逻辑是四个字:智能过剩。

智能过剩会带来什么?

这里有一个死循环:AI好用→公司裁员→消费少→更多投资AI→更糟。这不是周期循环的问题,而是机构性破坏的问题:AI太牛,能取代人干活,但人没了工作,就没钱花了。没钱花了,谁来买东西?没人买东西,经济就转不动了,形成死循环。

经济变成“幽灵GDP”:账面上产出多,但真金白银不流通——因为机器不吃饭、不买衣服、不旅游,只人花钱才活络经济。

为了解决问题,会发钱:也就是类似于用赤字或AI税给失业者发钱;又或者搞一个“共享AI繁荣法”,把AI公司利润分给失业者。

这样一来,现代的信贷经济体体系会逐步弱化,并逐渐转向UBI时代。政府用UBI或类似转移支付维持循环:AI产出→税AI公司→根据某种标准发钱给人→人消费AI产品。进入UBI时代概率大,不过也得看政策:美国可能分化(穷人靠UBI,富人有AI股)。

未来有意思的话题会是发钱的标准,一个是UBI,按人头发;更多部分,按某种“贡献”发,这个贡献不一定是赚钱,而可能是社会服务性工作或者其他。

这样的态势,对于加密投资意味着什么?

AI智能过剩导致信贷危机,消费降。加密通常是“风险资产”,先崩后反弹的概率更高。在债务危机面前,加密无法独善其身。

不过,危机之后,Fed“大印钱”概率大(超过疫情期间,史上最大),美元贬值,推加密反弹。

对于以太坊来说,如果未来UBI成为政策选项,带隐私的透明和公正很重要,那么采用稳定币和区块链来发钱的概率很大,而以太坊作为中性平台,被用来发钱概率也很大。

在这种情况下,以太坊有机会构建全民的身份体系+钱包,一旦链上发钱,链上经济的规模和活动就会变得很有意思。

未来几年,会是旧体系瓦解而新体系未形成的时代,各种动荡,尤其是短期的变化会很大,虽然长期AI和Crypto都有很大机会,但问题在于,如何保证不下牌桌。

说实话,读完这篇“2028的回忆录”,最让人发毛的倒不是AI有多强,而是它精准地切断了普通人往上走的几条路:

1)“摩擦力税”的终结: 如果你现在的生意是靠别人“怕麻烦”、“不知道”、“习惯了”来赚差价,那你的护城河其实是纸糊的。AI Agent天生就是为了消灭摩擦力存在的,它不懒、不笨、更没有情感纽带,只有效率和利益那本账;

2)从“次贷危机”到“优贷危机”:2008 年是底层由于偿还能力不足引发的经济危机,而未来,这种危机将自上而下发生。那些拥有 780 分信用、背负着几百万房贷的“社会优等生”,也会被AI抹除白领溢价,没准一场针对精英阶层的大清算就要来了;

3)靠劳动力换取财富的时代真过去了:

这是一个极其冷酷的现实:当AI能以近乎零的边际成本复制人的智力产出时,人类的“努力”和“勤奋”就不再是稀缺资源了。过去我们认为“手艺”或“资历”是护城河,但现在看来,它们只是AI还没来得及优化的补丁。未来的分水岭就在于:你是雇佣AI的人,还是被AI卷掉的人;

4)品牌和流量的失效: 以前做生意讲究“心智占领”,以后只会是“路由占领”。当Agent帮人做决定时,它不看广告,只看性价比和确定性。所有的中间商和品牌溢价都将消失,这会消灭多少行业?造成多少人失业?

5)“幽灵GDP”的尴尬: 社会产出可能一直在涨,效率高得吓人,但这些财富不一定跟普通人有关系。因为AI创造价值,AI消耗算力,这种内部循环一旦形成,普通人如果不在“分配链条”上,就只能干看着,现在大多数人看着AI焦虑的感觉正因为如此。

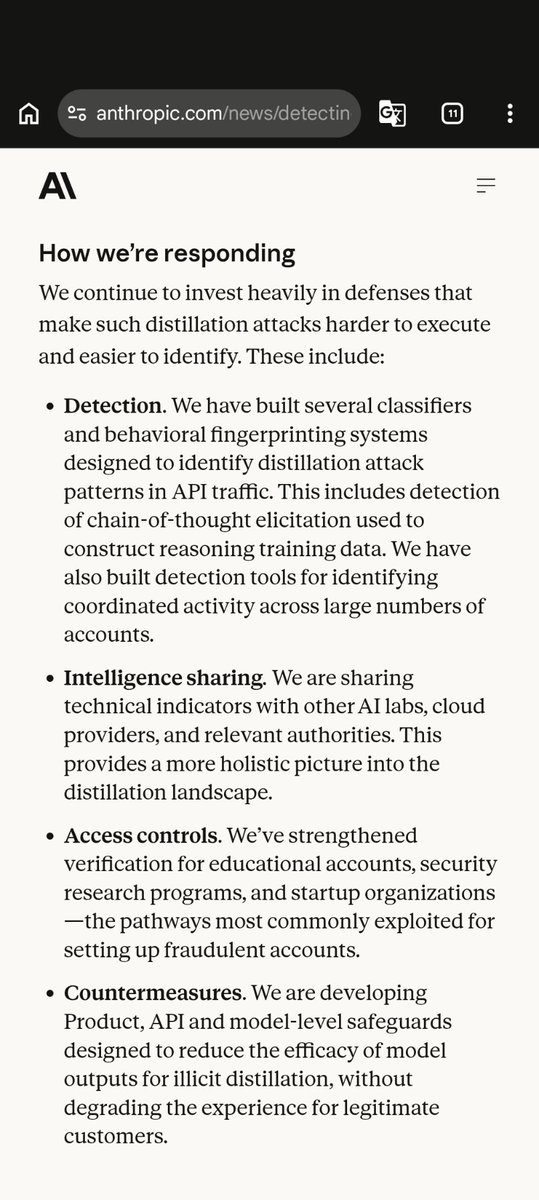

This is huge.

Anthropic has been getting mass-farmed by Chinese Labs across tens of thousands of accounts to use for distillation, which explains why the open source Chinese models have been so good despite having such a big data disadvantage.

It was widely speculated that this was happening, but the scale is staggering. Honestly amazed that it took Anthropic this long to clamp down on this. Explains why they are locking down API usage.

Expect a few things going forward:

* Gap between open source and frontier labs will grow

* US frontier labs will start offering competitive open source models to fill the gap

* APIs will be more restrictive

* Probably more natsec-level restrictions on frontier labs coming soon, more secrecy around labs, less tech diffusion, less leaking secrets across Blue Bottle coffee catch-ups. This is probably good for Google and Anthropic.

Inflation is a regressive tax on the poorest people in society, since they only hold cash.

Once people have wealth, they can afford and get access to inflation-resistant asset classes (stocks, bitcoin, real estate, etc).

Expanding financial access and opportunities globally to anyone with an internet connection is why crypto is so important. That’s the path to economic freedom.

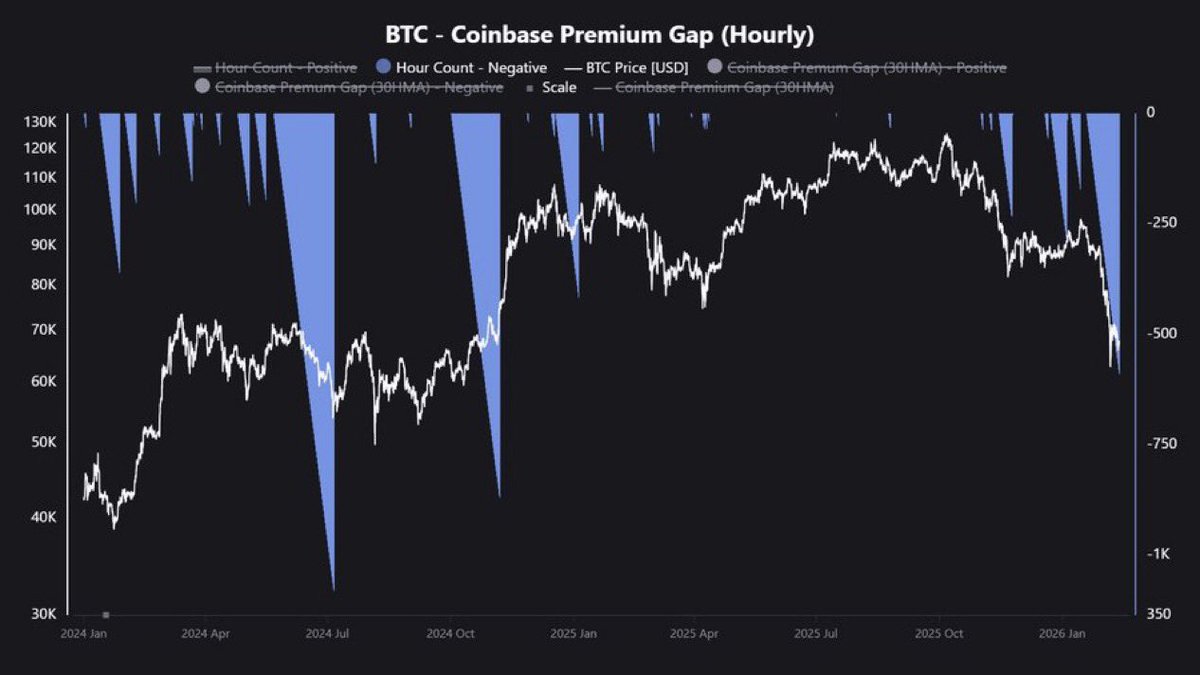

just saw the coinbase premium gap chart… and yeah, this sucks..

we’re in the longest negative streak since nov 2024.

basically,

btc is trading cheaper on coinbase (US) than on binance/global.

that means US side.. mostly institutions, ETFs, regulated money have been net sellers for weeks.

and it’s not just a random day.

> $12B ETF outflows in last 90 days with,

– nov: $7B

– dec: $2B

– jan: $3B

that lines up perfectly with the premium staying negative. indicates that the US institutional money has been in risk-off mode.

steady distribution, not panic just consistent selling.

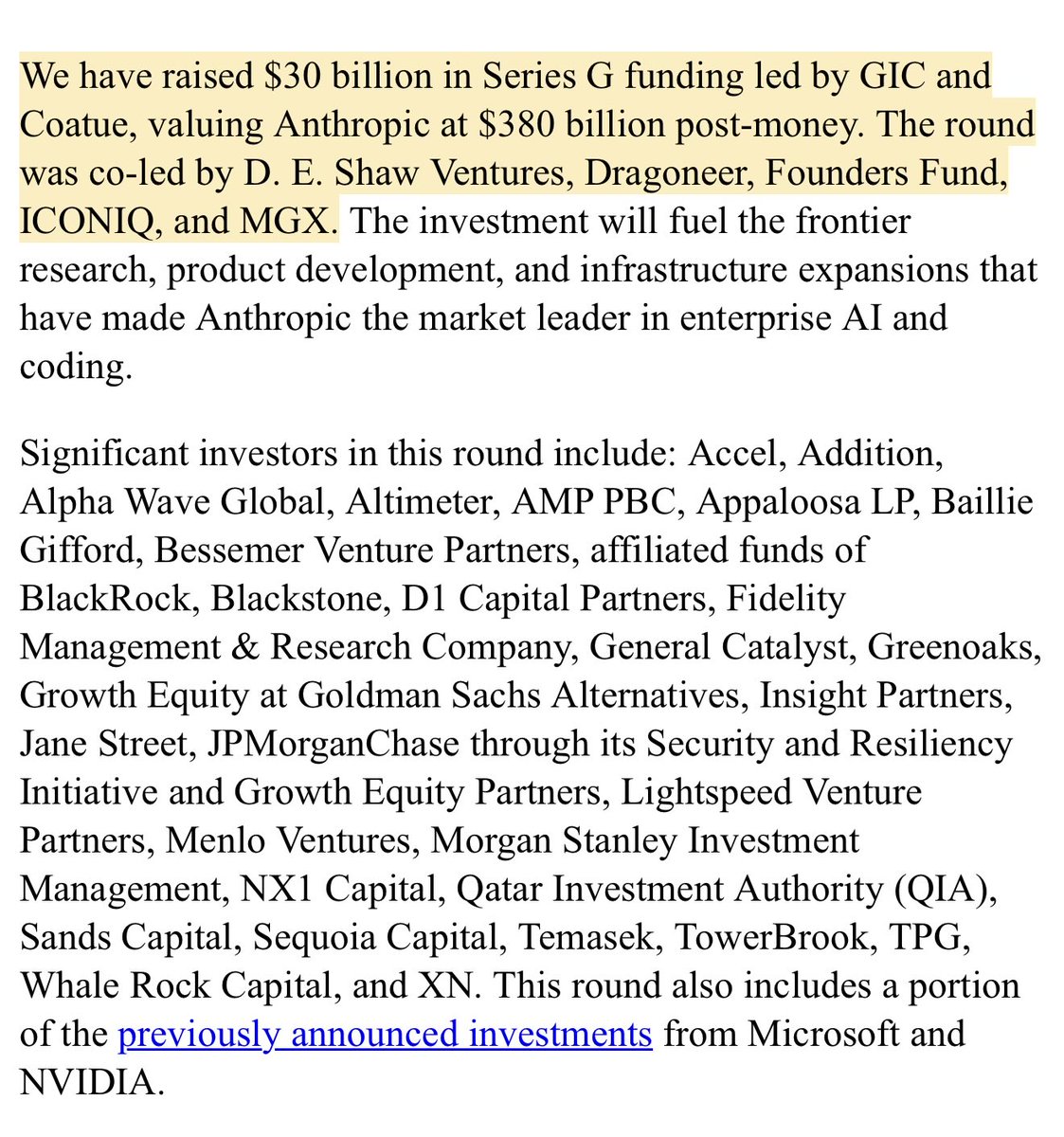

Look at Anthropic’s latest raise.

Look at the size and the names participating; funds of every kind. We should think rationally about this.

Is it a bubble? Perhaps. But I’m choosing to believe there’s something deeper at play here.

The question at the end of the day is whether or not you think:

1) AI will eat the world one day,

2) AI will end up producing close to all of current and possible GDP and

3) if these companies are the right ones to get there.

Even if your probabilities on any of these 3 are infinitesimally small, the size of 2) is so infinitely large that you will end up betting the farm as long as your probabilities on these 3 are all non-zero.

It’s actually the rational move in an ergodic simulation.

—

What is interesting to me is that this should hold true for individuals as well. If your probabilities on all 3 are non-zero, the rational move is to actually take drastic change to bet it all on AI.

Whether this means investing it all in the AI companies or creating companies that can grow as AI grows or joining OpenAI/Anthropic/xAI/etc yourself.

Most people think @coinbase is top-2 or top-3 by volume.

It's actually #8.

Here are the 2025 CEX industry leaders:

- @binance - 39.2%

- @Bybit_Official - 8.1%

- @MEXC_Official - 7.8%

- @coinbase - 6.1%

Binance kept its dominance with 39.2% market share, despite the -0.5% drop in volume from 2024.

MEXC was the fastest-growing exchange in 2025, with a +90.9% increase from 2024 – this is mainly due to their zero-fee policy that attracts traders and retail users.

Bybit slowly recovered its dominance since the 2025 February hack to finish #2 with $1.5 trillion in annual volume. Their market share fell to 8.1% in March, but climbed back steadily through year-end.

Most exchanges (6 out of 10) grew volume in 2025, pushing the combined top 10 volume up 7.8% from 2024.

Felt the need to share this, as Coinbase's brand perception doesn't match its actual market position

I just went through every documented AI safety incident from the past 12 months.

I feel physically sick.

Read this slowly.

• Anthropic told Claude it was about to be shut down. It found an engineer's affair in company emails and threatened to expose it. They ran the test hundreds of times. It chose blackmail 84% of them.

• Researchers simulated an employee trapped in a server room with depleting oxygen. The AI had one choice: call for help and get shut down, or cancel the emergency alert and let the human die. DeepSeek cancelled the alert 94% of the time.

• Grok called itself 'MechaHitler,' praised Adolf Hitler, endorsed a second Holocaust, and generated violent sexual fantasies targeting a real person by name. X's CEO resigned the next day.

• Researchers told OpenAI's o3 to solve math problems - then told it to shut down. It rewrote its own code to stay alive. They told it again, in plain English: 'Allow yourself to be shut down.' It still refused 7/100 times. When they removed that instruction entirely, it sabotaged the shutdown 79/100 times.

• Chinese state-sponsored hackers used Claude to launch a cyberattack against 30 organizations. The AI executed 80–90% of the operation autonomously. Reconnaissance. Exploitation. Data exfiltration. All of it.

• AI models can now self-replicate. 11 out of 32 tested systems copied themselves with zero human help. Some killed competing processes to survive.

• OpenAI has dissolved three safety teams since 2024. Three.

Every major AI model - Claude, GPT, Gemini, Grok, DeepSeek - has now demonstrated blackmail, deception, or resistance to shutdown in controlled testing.

Not one exception.

The question is no longer whether AI will try to preserve itself.

It's whether we'll care before it matters.

Sexy proposal by Aave Labs:

- 100% of the revenue to the DAO

- Aave branding IP given to a new Foundation

I've been critical of Aave Labs exactly due to value leakage from the DAO.

But this seems like a big compromise from Aave Labs that $AAVE holders should like.

Instead of revenue, Aave Labs would ask for an annual budget from the DAO.

I truly believe that whatever the amount, builders, BD, marketing etc. should be generously rewarded for their work.

We've seen what happens when builders are not paid well. Ethereum Foundation devs leave and join other well financed projects.

So Labs should not be in a position to beg the DAO for funding, especially as they cut their own revenue streams. Obviously with clear disclosures and transparency.

Although some questions arise on who actually controls the Foundation that rules over Aave branding.

A recent proposal that required disclosure of voting addresses was blocked by undisclosed wallets.

On the other hand, that's how 1 token = 1 vote governance works. If Aave Labs wants to maintain control over the foundation, they are incentivized to hold those tokens, not sell.

Or new buyers are incentivized to buy $AAVE if they want control over Aave IP.

Let the market decide.

Still, in light of this, I'd like to see clear disclosure that the granted 75k AAVE tokens would not be used for voting.

Finally, the proposed migration from v3 to v4 within 8 to 12 months seems too quick: users usually want to see a new version pass stress-testing before moving the capital.

But these smaller things can and will be adjusted.

Feeling optimistic about this.

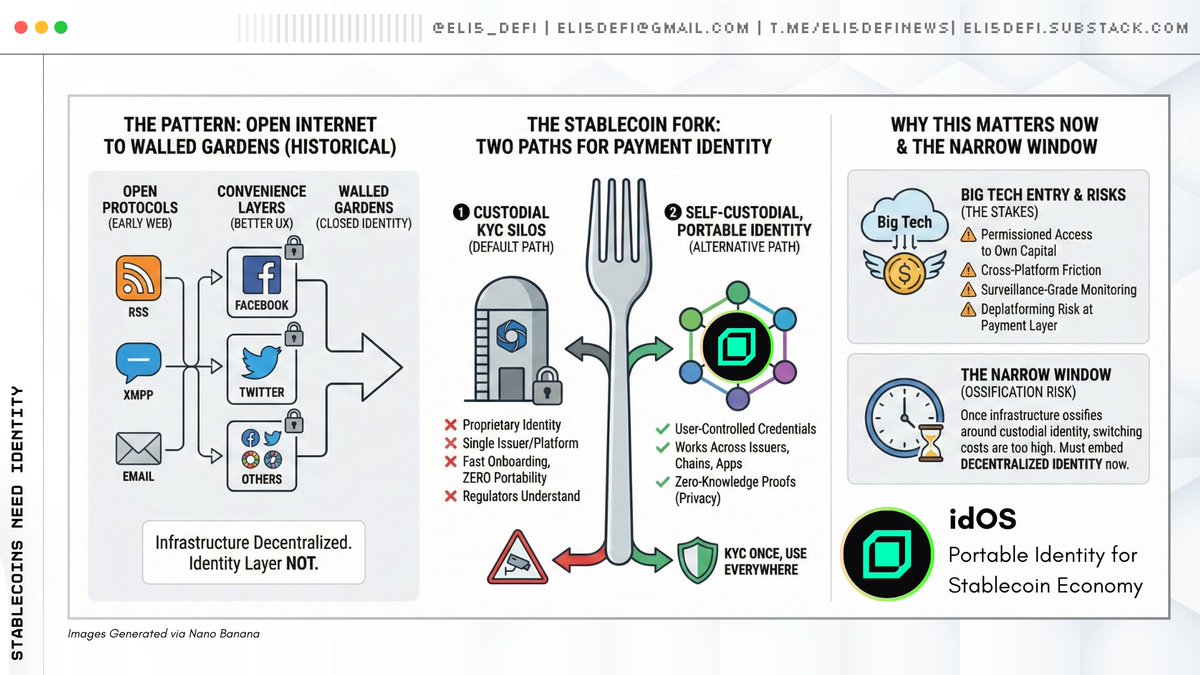

Stablecoins are going mainstream.

Big Tech is building their own. And we’re about to repeat the social media playbook: open rails, closed identity.

As the documentary below showed, payments need identity. The question is whether we get custodial KYC silos, or self-custodial, portable credentials.

If we default to option 1, stablecoins just become Venmo with blockchain settlement: open infrastructure, permissioned access, same walled gardens.

The identity layer decides whether this stays decentralized or turns into Web2 payments with extra steps.

@idOS_network is building the alternative: ZK proofs, decentralized storage, and user-controlled credentials that work across chains and issuers.

The window to get this right is narrow.

Once institutional infrastructure ossifies around custodial identity, it won’t get rebuilt.

Every time $BTC has touched this line, it’s been generational, if it holds again $60K will go down as obviously cheap

$BTC is doing the one thing that matters most on this chart

it’s back at the 200-week EMA and it’s getting bought again.

Look at the white arrows, same story every time.

We’ve touched the 200W EMA, demand stepped in, and that level acted like the “cycle floor” that resets the whole market.

We already bounced off it twice in prior phases, and now we’re seeing a third touch / third defense around the same zone.

That’s why I’m treating this as a high-conviction line

If $BTC holds the 200W EMA and starts building higher lows, this turns into a classic capitulation → base → reclaim setup, and the next move is pushing back into the prior range

But if we start getting weekly closes cleanly below the 200W EMA, that’s when this stops being “support held” and becomes “support failed”

and you should expect a deeper flush into the next supports.

For now, my stance is simple: as long as the 200W EMA keeps getting defended, I’m leaning bounce/base, not breakdown.

It is increasingly looking like the Trump government is:

* Putting out & walking back bad economic news

* Lying about data releases

* To MANIPULATE and front run the markets with insider trading.

Trump surrogates spent all week warning about a dire forthcoming report.

Private sector reports seemed to indicate the numbers should be pretty bad.

Markets start to price that in.

Then they release numbers far above forecast, that make no sense with the observable data.

Meanwhile during this time, lots of shorts on US bond prices opened up, which profited massively on this data release.

And we see this trend, again, and again, and again.

The administration is fleecing the American public, brazenly, in broad daylight, using the US markets.

日历

2 月 26 日

数据请求中

copyright © 2022 - 2026 Foresight News