TL;DR

A major deleveraging event swept through crypto this week, fueled by hawkish Fed commentary and a record options expiry. On Typus, this resulted in Open Interest collapsing by nearly two-thirds to ~$505K. Traders were hit hard for a second consecutive week, with a -$71.2K loss. LPs also saw a negative week ( -5.83%), driven by the broad market sell-off, though trading volume remained muted at ~$3.3M as the market reset.

Major Deleveraging Event Sweeps Through Crypto

The prevailing market narrative this week centered on a major deleveraging event, with the crypto market experiencing one of its heaviest liquidation cascades in the past six months. The sell-off was reportedly driven by a combination of hawkish rhetoric from Federal Reserve speakers and a record-breaking Bitcoin options expiry, where bears successfully pushed the spot price below key strikes, triggering a flush of long positions.

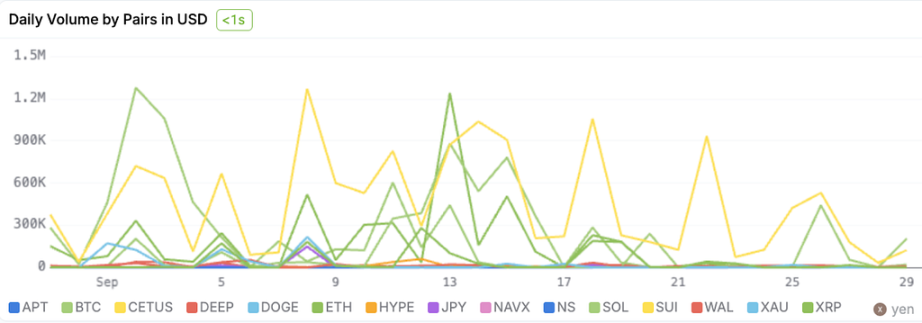

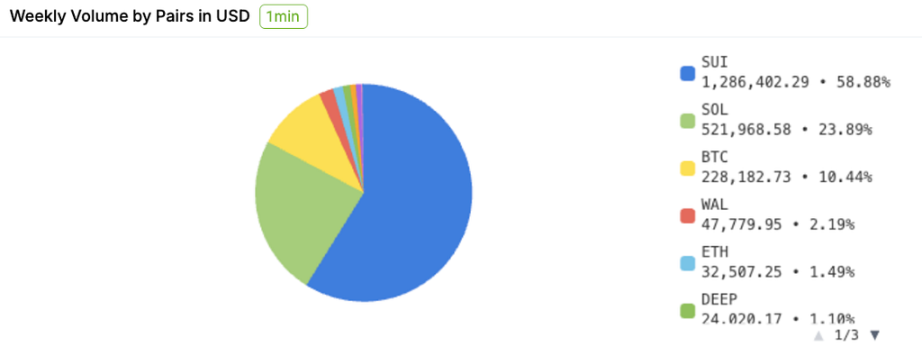

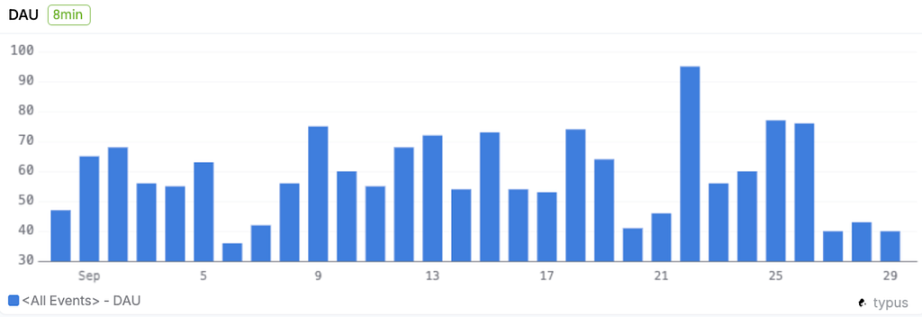

This macro-driven event led to a continued cooldown in regular trading volume, which fell by 44.49% to ~$3.3 million. However, in a likely reflection of users monitoring their positions during the crash, average Daily Active Users (DAU) surprisingly increased by 12.8%.

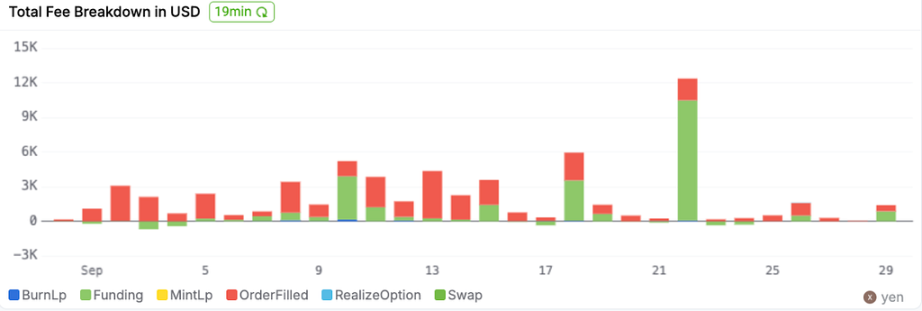

LP Returns Impacted by Broad Market Sell-Off

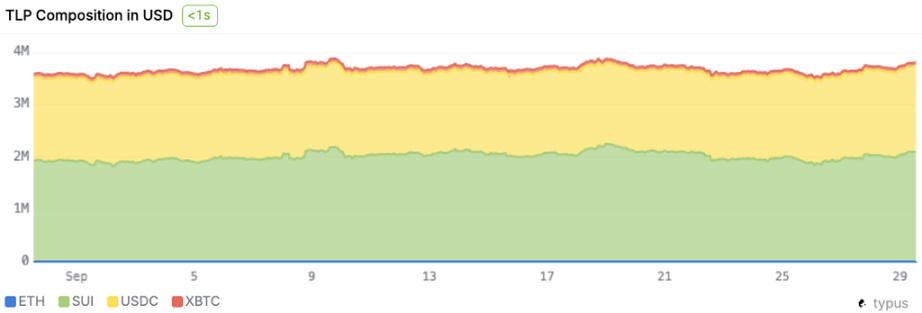

It was a challenging week for LPs amidst the broad market downturn. The TLP token’s return was -5.83%, primarily driven by the underlying asset basket’s sharp decline of -5.02%. Despite the market turmoil, TLP fees saw a notable increase of 38.8%, largely due to an increase in realized funding fees from the chaotic price action.

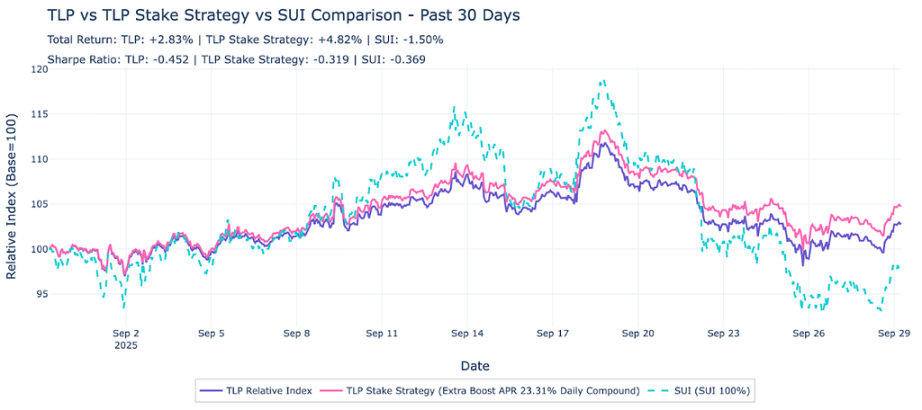

TLP vs. SUI: A 30-Day Performance Deep Dive

Despite the sharp downturn this week, the 30-day performance data continues to highlight the TLP’s relative stability. The TLP Stake strategy delivered a positive +4.82% return over the past month, and the standard TLP was up +2.83%. Both significantly outperformed holding SUI spot, which saw a -1.50% loss over the same period, underscoring the TLP’s value during market volatility.

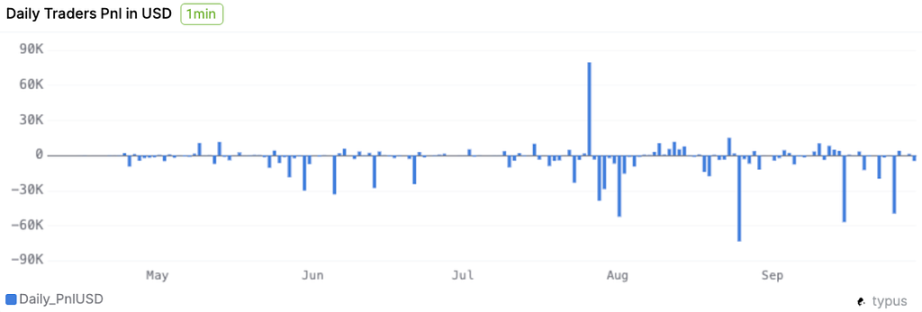

Traders Hit Hard in Market-Wide Liquidation

It was another very difficult week for traders, with realized losses totaling -$71,222.15. This marks the second consecutive week of heavy losses and is a direct result of the market-wide deleveraging event that caught many long-positioned traders offside.

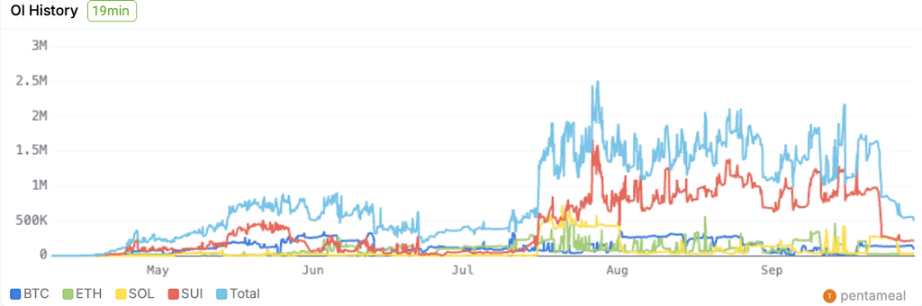

Open Interest Collapses in Major Deleveraging

The most significant event on the platform this week was the massive drop in leverage. Total Open Interest plummeted by nearly two-thirds, falling from ~$1.5M last week to just ~$505K this week. This signals a major reset of speculative froth and a return to a more cautious market environment. The overall long/short ratio has normalized to a slightly bullish 1.74, reflecting the closure of a vast number of leveraged positions.

Ultimately, the week represented a significant and painful deleveraging for the crypto market. It was a tough week for all participants but served to flush out the excess leverage that had built up. With market sentiment and positioning now reset to a much cleaner state, the market has a new, more stable foundation from which to build its next directional move.

【免责声明】市场有风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。