TL;DR

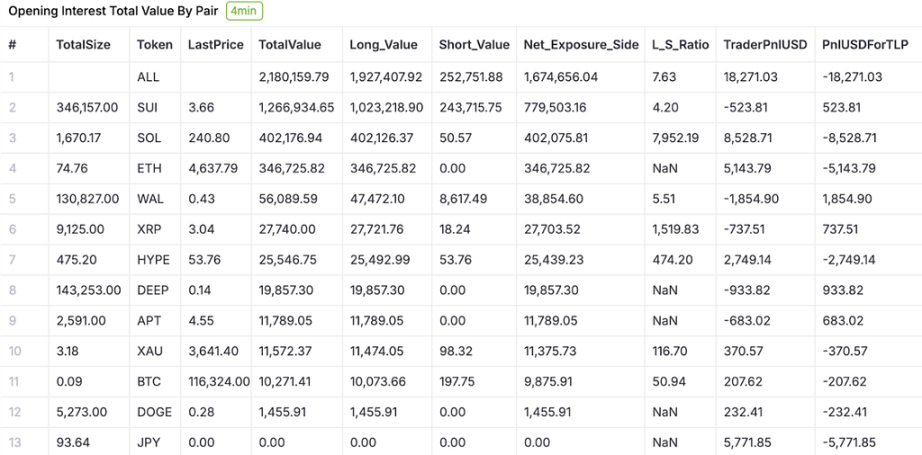

Anticipation of a dovish FOMC decision fueled a risk-on rally this week, with trading volume on Typus surging by 59% to ~$13.4 million. Traders successfully capitalized on the move, reversing last week’s performance to book +$21.4K in profits. LPs also enjoyed a solid +3.31% return. Open Interest hit a new all-time high of ~$2.1Mn, with market sentiment turning extremely bullish, led by momentum leader SOL.

Market Front-Runs FOMC as Volume Surges 59%

The prevailing market narrative this week centered on traders positioning ahead of the upcoming US Federal Open Market Committee (FOMC) rate decision. With the market almost fully pricing in a dovish rate cut, a confident, broad-based rally in risk assets took hold. The market consensus suggests this was a classic case of “front-running” the expected news.

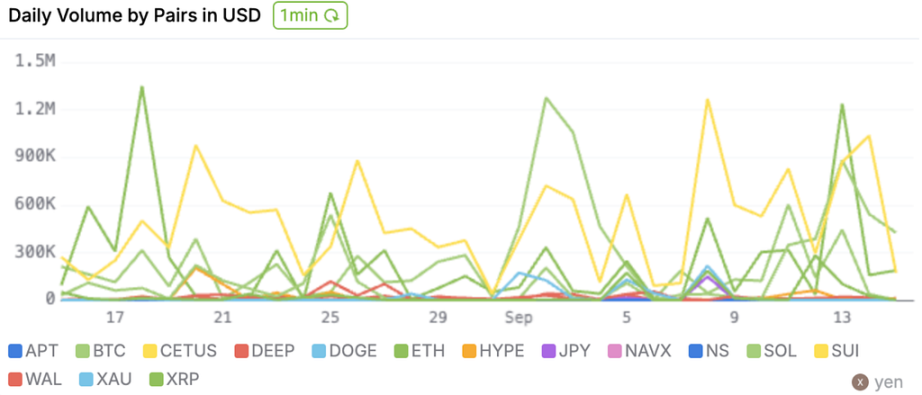

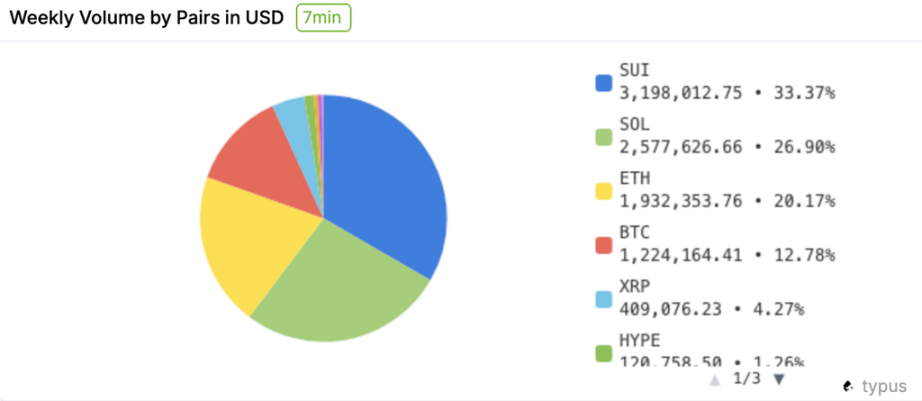

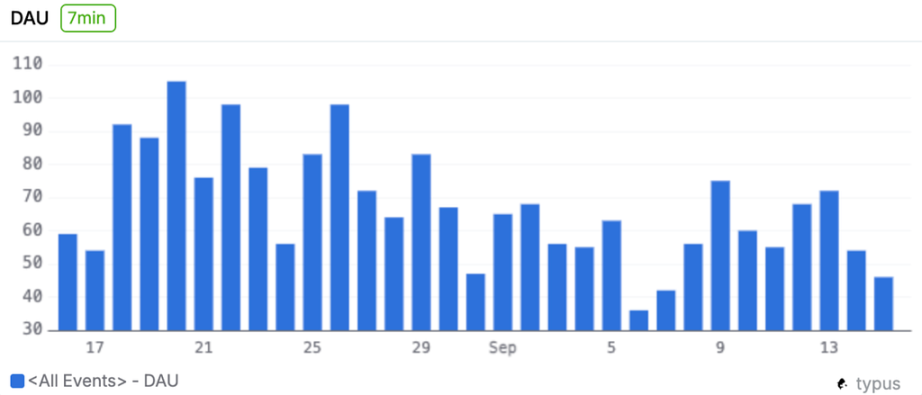

This bullish conviction led to a strong rebound in platform activity. Total trading volume surged by 59.13% to ~$13.4Mn, a significant increase from the previous week. Average Daily Users (DAU) also saw a healthy 12.5% rebound, indicating that traders were confidently returning to the market to chase the rally.

Traders Capitalize on Rally with +$21.4K Profitable Week

Traders successfully rode the bullish wave, booking a strong realized profit of +$21,415.77. This performance completely reverses the prior week’s loss and is supported by a healthy unrealized PnL of +$29,901.69, showing their current positions are strong.

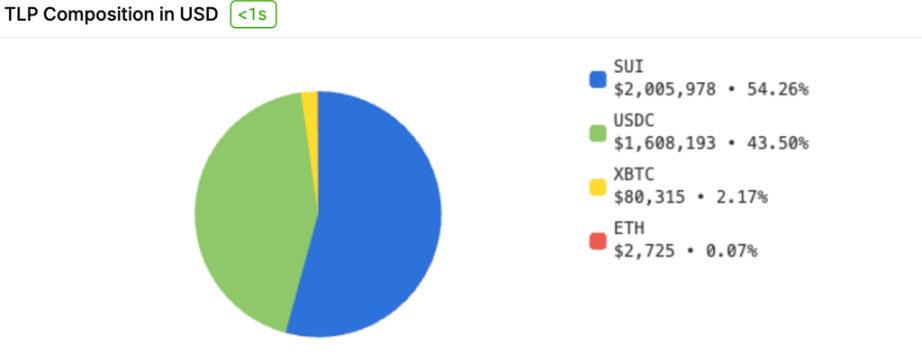

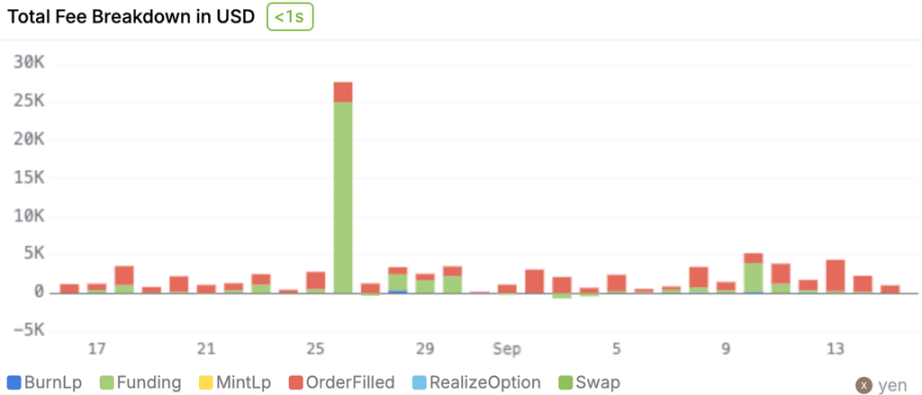

LPs Secure Solid Gains While Paying Out Winning Traders

It was a positive week for liquidity providers, who captured the market’s updraft. The TLP token delivered a solid return of +3.31%. This performance was primarily driven by the underlying asset basket’s strong appreciation of +4.71%, with assets like SOL (+19.6%) and ETH (+7.9%) leading the charge. The TLP’s slight underperformance relative to its basket is a direct result of the pool acting as the counterparty and paying out ~$21.4K to winning traders, a sum which was larger than the ~$17.7K in TLP fees generated during the week.

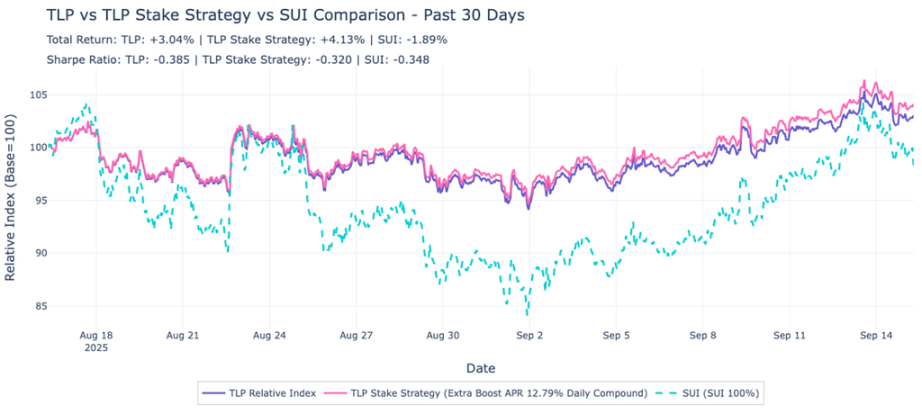

TLP vs. SUI: A 30-Day Performance Deep Dive

The 30-day performance data shows a positive turn for all strategies amidst the market recovery. The TLP Stake strategy leads the pack with a +1.51% return over the period, while the standard TLP is up +1.08%. Both continue to outperform holding SUI spot, which is down -2.67% over the same timeframe.

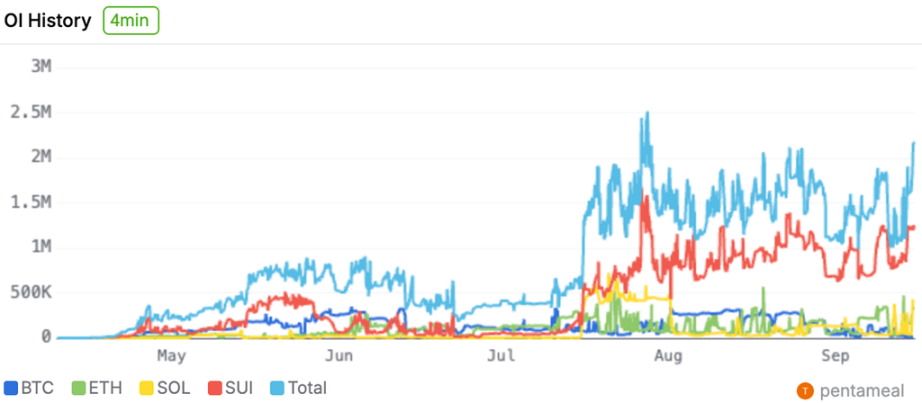

Open Interest Hits Recent High as SOL Leads the Charge

The clearest sign of market conviction was the surge in leverage. Total Open Interest climbed to a recent high of ~$2.1Mn. Market sentiment has turned extremely bullish, with a long/short ratio of 7.18. The narrative of an “altcoin season” is gaining strength, with SOL emerging as the clear momentum leader. Conviction in SOL is exceptionally high, with its OI growing to nearly match that of BTC and its L/S ratio hitting an incredible 7,952.

The key takeaway this week is the decisive return of risk-on sentiment ahead of the FOMC meeting. The surge in volume and Open Interest to new all-time highs shows conviction has fully returned to the market. While LPs took a backseat to profitable traders this week, the entire ecosystem benefited from the renewed activity. All eyes are now on the Fed for the market’s next major catalyst.

【免责声明】市场有风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。