We recently invested in @Pendle_fi via OTC purchase with the foundation, and are excited to support the team on their journey to bringing interest rate derivatives market on-chain. We share our investment thesis, product highlights, and near term growth catalysts below.

The complete toolkit for yield strategies

Interest rate derivatives in traditional markets turnovers daily in the trillions as participants use them to speculate or hedge against rate moves. As the DeFi sector continues to mature, such yield opportunities will also steadily increase. Be it providing liquidity for traders on GMX/Gains Network or even liquid staking derivatives like Lido, there is no shortage of options for yield chasers. But where can users go and speculate on yield today? For instance, what if I feel that the current yield provided by GLP is undervalued and is poised to increase in the coming days? What if I feel that the current Stargate yield doesn’t accurately reflect the stablecoin trading volume and might fall soon? What if I just want to take a market neutral position and earn extra yield?

With near term yield speculation opportunities such as the Shapella upgrade, Vu Gaba Vineb has succinctly outlined the various possibilities that ETH and LSD yield might go — whether you think it’ll go up, down or sideways, Pendle has strategies that allow you to capitalize on those outcomes.

Pendle provides the toolkit for users to enjoy fixed yields via discounted asset purchases, speculate on yield through YT (covered more below), or participate in their pools to earn additional yield through swap fees and rewards. Protocols such as Equilibria is already utilising Pendle to build more yield boosting strategies and we foresee more protocols to start building on top of Pendle in the near future. On the retail access front, Pendle has also done a great job in simplifying the UI/UX for users to engage in various yield strategies.

We are excited about Pendle opening a new paradigm for yield speculators as they are now able to adjust the risk profile of their underlying assets against the sometimes volatile markets.

Product Highlights

Pendle Finance was founded in 2021 and is a DeFi protocol where users can purchase assets at discounted prices, engage in various yield strategies, or earn yield by providing liquidity for their pools. It is currently deployed on Ethereum and Arbitrum. The total value locked (TVL) grew rapidly from $7.8 million in Dec 2022 to $60.5 million today, a growth of close to 775% in just five months.

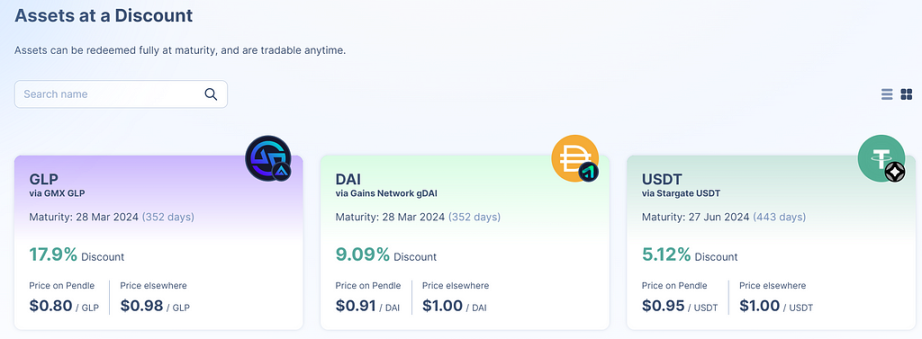

SY, PT & YT

Pendle is a yield trading protocol where we can tokenize the yield of a yield bearing asset (like GLP, stETH, aUSDC, etc) into YT and PT, where YT receives the yield, and PT represents the principal investment amount. Users will be able to purchase PT at a discount, since the yield component of YT is stripped away. For instance, buying PT-GLP is equivalent to getting GLP at a discount and 1 PT-GLP will be redeemable for 1 GLP at maturity. How is the PT-GLP discount determined? Fundamentally, the discount rate is derived by the market demands for PT-GLP. If there is a huge demand for PT-GLP, naturally the discount would decrease while the opposite holds true when there is lesser demand.

It’s also important to understand what SY is — a token standard that implements a standardized API for wrapped yield-bearing tokens within smart contracts. Yield from the principal of these yield-bearing assets can then be stripped into PT and YT tokens. Looking at the diagram below, SY refers to the underlying yield bearing asset (aUSDC in this case), which is then split into PT-aUSDC and YT-aUSDC. This unlocks a plethora of strategies for users.

Users who are keen to hedge against volatile yields can do so by purchasing PT at a discount today and holding them to maturity. For instance — if PT-GLP is trading at 22.5% discount, it means that if you were to buy 1 PT-GLP today, you’re essentially locking in that 22.5% yield and getting a fixed return. You’re also taking the view that the future yield will be below 22.5%, which gives you the opportunity to either sell PT-GLP for a profit or get a higher yield return compared to holding just GLP. On the other hand, users who want to speculate on future yields can purchase YT tokens to compound their further exposure to your yield. In this case, you might take the view that 22.5% yield is undervalued, and you can buy 1 YT-GLP today and sell it when the yield rises above 22.5% or earn the extra yield until maturity. In summary, buying PT is equivalent to shorting yield while buying YT is equivalent to longing yield.

LP Pools

For users looking for a more passive strategy, liquidity provision on Pendle is simple and easy. There are four sources of yield that make up the pools APY:

a) Fixed rate from PT; which comes from holding PT to maturity

b) Protocol rewards from underlying token; which comes from yield-bearing assets (e.g. GLP)

c) Swap Fees; from the trades SY, PT & YT

d) Pendle incentives; boosted yields by staking Pendle for vePendle

As you can see, the yields are extremely attractive and because of the high correlation in pool assets, coupled with Pendle’s unique AMM design, users are exposed to little to no impermanent loss. We should see an increase in yield-bearing assets integrated over time.

Unique AMM Design

In Pendle v2, the major innovation is in the design and construction of an AMM trading platform designed for yield trading. Given the pools are also all highly correlated assets, this will reduce the typical IL that comes with volatility in the pair of assets. More importantly, if asset stays in the pool until maturity, there will be 0 IL because at maturity, PTs in the pool will be equivalent to the underlying. Overall, users will be able to trade between SY, PT & YT with little to no impermanent loss.

Greater capital efficiency is another feature of Pendle’s v2 AMM. With the introduction of flash swaps, users can now purchase YT easily on a simple UI to begin engaging in various yield strategies. This means that LPs can earn fees from both PT and YT swaps within a single liquidity provision, while traders can enjoy greater liquidity and therefore lower slippage.

With the emergence of various yield-bearing assets, whether they are generated through lending platforms (such as Aave, Compound, etc.) or through staking on LSD platforms, there is a massive market that Pendle can expand into.

vePENDLE

Pendle borrows the veCurve and Solidly model, where existing token holders can stake $Pendle to receive $vePendle, which reduces the circulating supply of $Pendle on the market. One key attraction of $vePendle is to earn a cut of protocol revenues. Today, there are two protocol revenue streams in PendleV2:

a) YT fees: Pendle takes 3% of all yields generated from YT.

b) Swap fees: Pendle takes 0.1% of value transacted, which goes down as the time to maturity is shorter, and vice versa.

c) 20% of the fees above go towards liquidity providers, and the remainder will be distributed to $vePendle holders. On top of that, yields from PT that have matured will also be proportionally distributed.

d) $vePendle token holders can also direct $Pendle rewards to liquidity pools on a weekly basis based on their vote weight, and receive boosted rewards (up to 2.5x) on any Pendle pool that they have provided liquidity in.

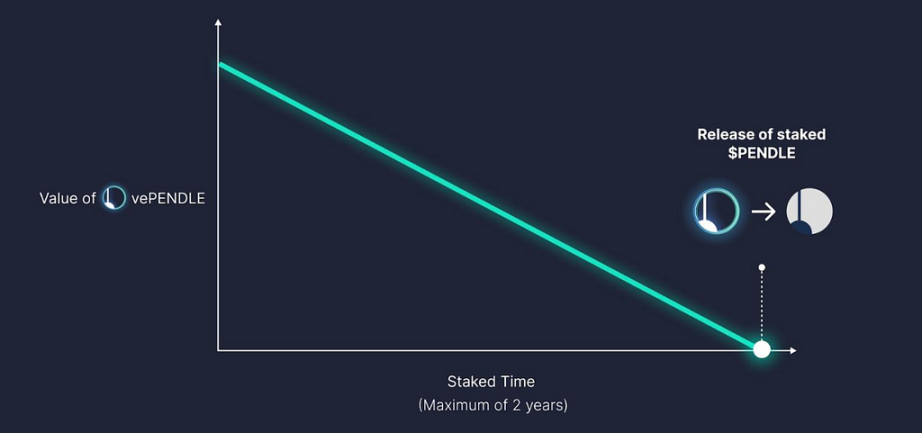

$vePendle decreases linearly over 2 years, after which the underlying $Pendle will be released. Therefore, users who wish to maintain their vote weight/value of their $vePendle tokens will have to extend their staked duration or amount staked.

Near Term Growth Catalysts

Explosive growth expected for LSDs

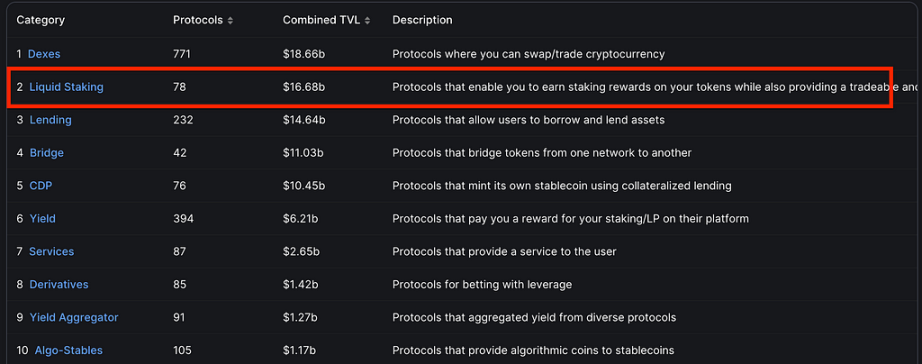

With withdrawals enabled after Shapella, liquid staking derivatives will be able to maintain their peg better, making them better borrowing collateral. This should drive increased utilisation across DeFi protocols. As of 6 April 2023, Defillama data shows that the TVL of the LSD industry has grown to $16.6 billion, ranking second among all Defi tracks.

In an ecosystem that’s prepared to bloom, Pendle is positioned to be a core piece of infrastructure supporting it. It has garnered impressive traction, with recent support from major players like Lido, Frax, Rocketpool, Aura, GMX and Stargate. We foresee that TVL growth will continue to climb as the protocol garners more partnerships and the ecosystem begins to appreciate Pendle’s impressive design for Liquidity Provision.

Instead of trying to pick LSD winners, we like Pendle’s unique positioning as the supporting protocol.

Users who wish to take a more active approach to hedging or boosting yields on their LSDs should keep an eye on Pendle’s discounted assets.

Gap in the market for fixed income products

Fixed income products are commonplace in traditional finance but less seen in crypto. Yield volatility has always been a theme for crypto, with stETH’s yields fluctuating between 4–5% typically, with a peak of 7.1% in the last 30 days, and even 10.2% in Nov 2022.

Volatile yields induce uncertainty, especially for investors with leveraged positions. This requires more active management of their yields, where investors need to weigh up the opportunity cost and risk of their positions against alternative Defi projects. Therefore, fixed rate returns present a more efficient and effortless strategy for these type of investors.

Conclusion

In summary, we think Pendle today offers a diverse toolkit for users to manage various yield strategies. Both the fixed income and interest derivatives market within traditional finance are huge and we think that Pendle will be able to attract institutional capital as the protocol gets more battle tested with time.

Pendle’s approach to using a standardised token standard for yield bearing assets makes it easy to integrate more yield-bearing assets in the future, and it unlocks composability for other DeFi protocols to build upon or integrate with it.

Disclaimer: Bixin Ventures are investors in Pendle and everything mentioned is for educational purposes only and should not be construed as financial advice.

Article Contributors: Evan Gu, Henry Ang, Mustafa Yilham, Allen Zhao, Jermaine Wong

【免责声明】市场有风险,投资需谨慎。本文不构成投资建议,用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。